You do not have to be in your new state for 183 days just outside the. In California the effective property tax rate is.

Nevada Vs California Taxes Retirepedia

You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like NevadaThe second rule is that California will tax income generated in the state regardless of where you live.

. However there are reciprocity agreements and credits that could help offset. Reporting and paying taxes on unearned income might still require filing a tax return. You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return.

79 and in Nevada its. Therefore unless you have taxable income other than W-2 wage income such as stock sales earned interest dividends rental property income etc you can safely assume that CA will be taxing. Can the state of California tax me on wages if I lived in Nevada all year.

4 Only when you live in NV and work in NV does CA not tax your wage job income. In California partnership LLCs pay a tax ranging from 1700 to almost 12000 per year depending on the net taxable income of the entity. Living in any of the other 41 states will mean filing and paying state income taxes.

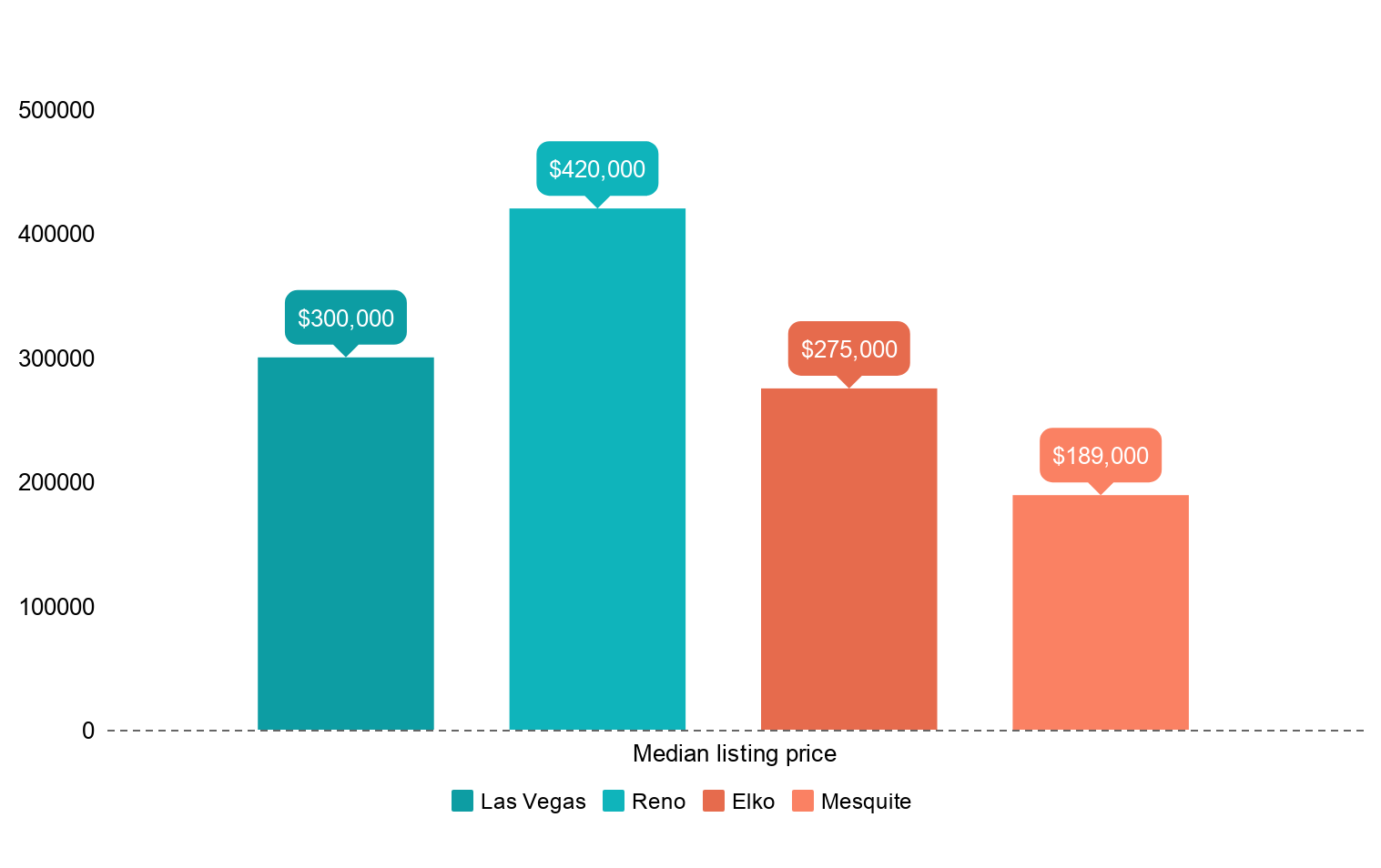

But these agreements cover only earned income what you collect from employment. The confusing part is whether or not you will have to pay taxes in the state where your employer is located. When it comes to property tax Nevada and California boast similar rates.

If you move to Nevada Texas or one of the other states without an income tax that money goes straight back into your pocket. My experience has shown me that if it is Primary than the tax advantages can be more substantial. Californias Franchise Tax Board administers the states income tax program.

For instance if you live in California and you have 1500000 in taxable income your state income tax bill comes out to approximately 175921. How long do you have to live in Nevada to be a. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. Thats due to the source rule. The state of California requires residents to pay personal income taxes but Nevada does not.

3 If you live in CA and work in CA then CA taxes all of your wage job income. So if you own California real estate but live in New York you still have to pay. If you move from California to Nevada this seems to avoid California state taxes in many instances.

California Tax Rules For Remote Employees. If you live in Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas or Washington you wont be taxed. If you live in California you probably know how aggressive Californias state tax agency can be.

In fact even if you live somewhere else you might have heard of. If you are a resident of Nevada and are employed in California you will be taxed by California. Yes you need to file a non-resident state return for the California income.

How long do you have to live in Nevada to be considered a resident. In California S-corporations are taxed at a rate of 15 on the net taxable income with the minimum tax being 800. If you receive a California pension but you are not a resident of California you may still have to pay taxes on this income to your state of residence or the federal government.

Youll pay state income tax in both the state you work and the state you live provided both states have an income tax. The state of California requires residents to pay personal income taxes but Nevada does not. Does the fact that you lived in California from Jan.

Say however you move on June 30 2011. In Nevada there is no income tax imposed on S-corporations. In Nevada there is no income tax imposed.

As a resident we have no state income tax if you earn your money in Nevada or if you have passive income even if it comes from California. California taxes all taxable income with a source in California regardless of the taxpayers residency. Californias Franchise Tax Board administers the states income tax program.

Assume there is no Nevada location of the Company. 1 to June 30 2011 make all of your 2011 income taxable as if you were a California resident for the entire year. That means Californians pay substantially more property tax than Nevadians.

This is enough to get them a little over one extra year of income. Furthermore below you can see a year-by-year breakdown of Bob and Janes estimated taxes. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

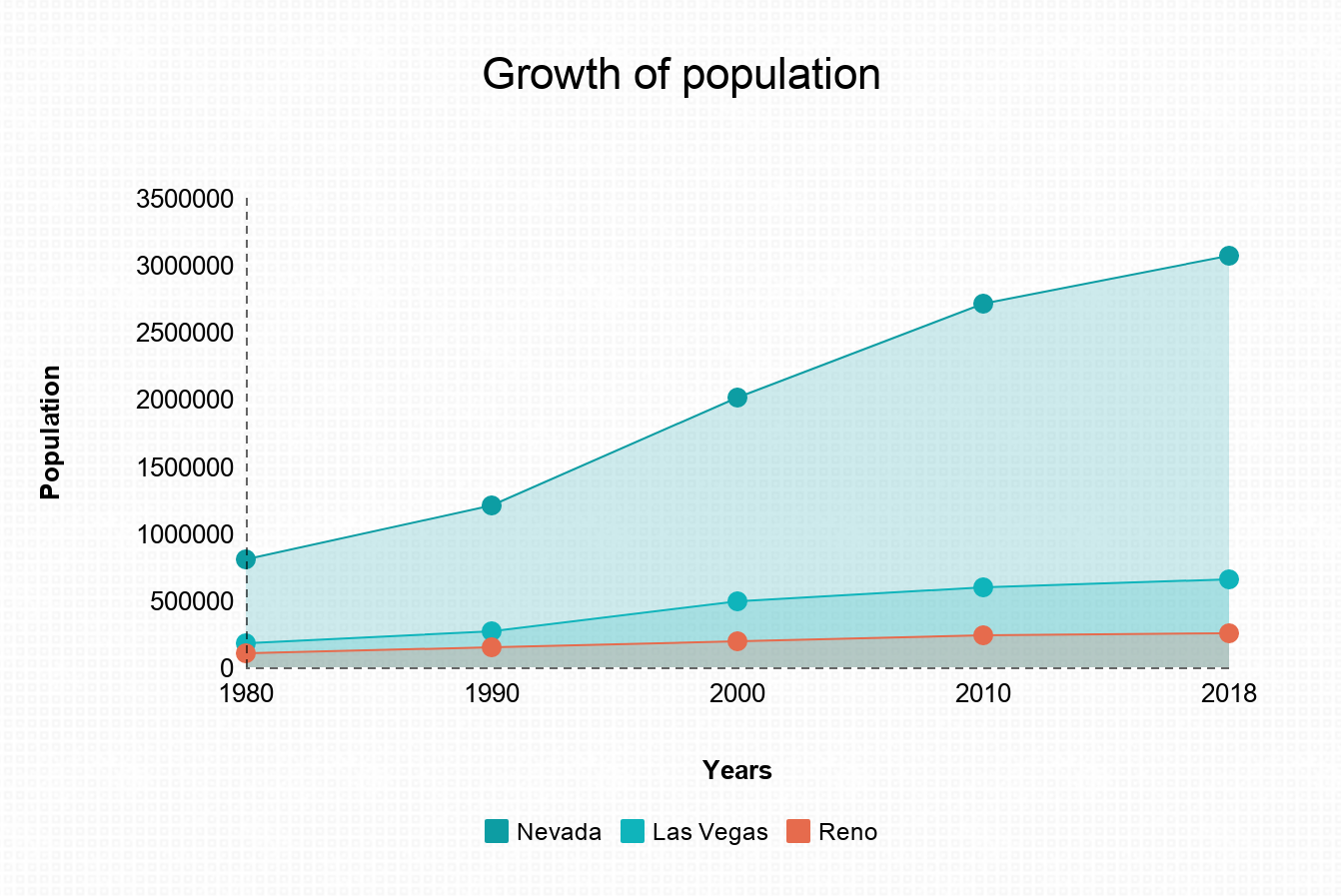

By simulating a move to Nevada from California we find that Bob and Jane save over 156000 in taxes throughout their retirement. You wont have to file a return in the nonresident state if your resident state and the state in which youre working have reciprocity. Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services.

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Nevada Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Pros And Cons Of Moving To Nevada From California

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Does California Tax Income Earned In Other States

Moving To Nevada From California Retirebetternow Com

Moving Avoids California Tax Not So Fast

The 10 Happiest States In America States In America Wyoming America

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

Pros And Cons Of Moving To Nevada From California

Nevada The New California The Nevada Independent

States With No Income Tax H R Block

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Qua Healthcare Education Health Care Social Determinants Of Health

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

Nevada Vs California Taxes Explained Retirebetternow Com

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map