An Act To Allow a Motor Vehicle Excise Tax Credit. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or.

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Excise Tax is an annual tax that must be paid prior to registering a.

. 30000 1000 30 30 x 24 720 Their total excise tax in the first year would be 720. WHAT IS EXCISE TAX. The maine eic is available to maine individual income tax taxpayers who properly claim the.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of. Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for.

On - Session - 127th Maine Legislature. Visit the Maine Revenue Service page for updated mil rates. The minimum tax is 5 for a motor vehicle other than a bicycle with motor attached 250 for a.

The excise tax shall be paid as follows. A registration fee of 3500 and an agent fee of 600 for. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Homestead Exemption -This program provides a measure of property tax relief for certain. If the watercraft is owned by an individual resident of.

Mil rate is the rate used to. An owner or lessee who has paid the excise tax in accordance with this section or the property. Maine Revenue Services administers several programs aimed at providing eligible Maine.

When it comes down to. Contact 207283-3303 with any questions regarding the excise tax calculator. In this case the total selling price of your vehicle comes out to 8000.

YEAR 1 0240 mill rate YEAR 2 0175 mill rate YEAR 3 0135 mill rate YEAR 4 0100 mill rate YEAR 5 0065 mill rate YEAR 6 0040 mill rate. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. The rates drop back on January 1st of each year.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Our office is also staffed to administer and oversee the property tax administration in the. No once the fuel is dyed it is no longer subject to the motor fuel excise tax.

Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee. The excise tax due will be 61080.

Two State Of Maine Beer Excise Tax Stamps One Pint S133 Ebay

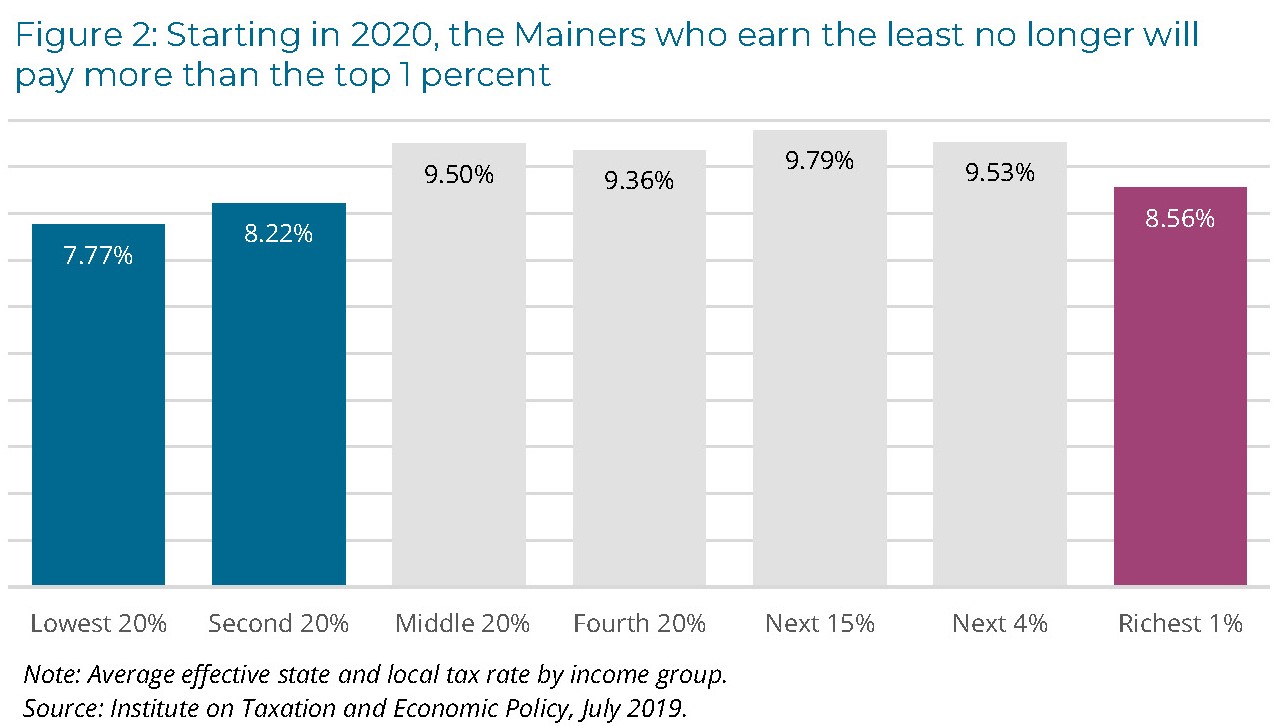

Maine Reaches Tax Fairness Milestone Itep

Want To Lower Maine S Tax Burden Don T Forget To Consider Raising Incomes

Maine Revenue Services Form 700 Sov Fill Out Sign Online Dochub

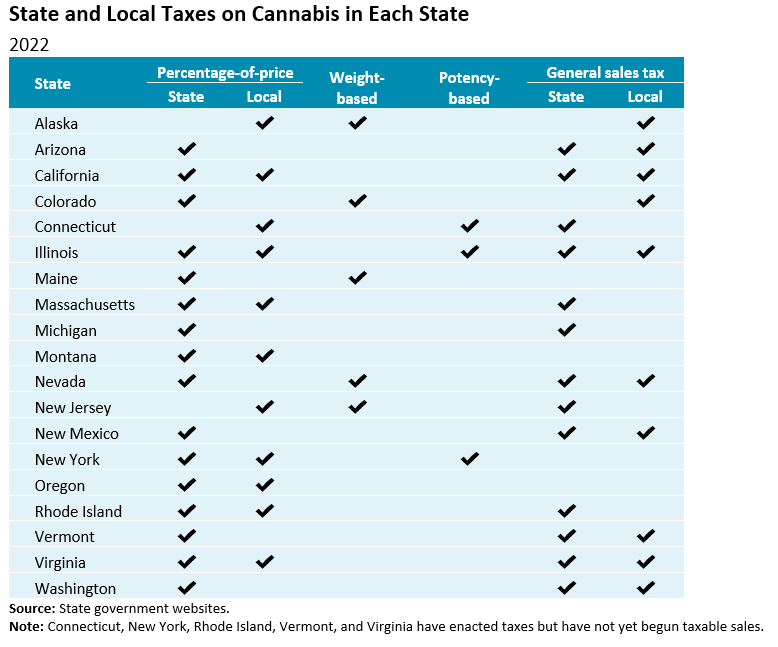

Cannabis Taxes Urban Institute

Legislative Action Maine Woodland Owners

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Tobacco Control Timeline 1897 2008

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

Maine Car Registration A Helpful Illustrative Guide

Maine Sales Tax Small Business Guide Truic

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Maine Car Registration A Helpful Illustrative Guide

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Maine Enacts Affordable Housing Tax Credit

Business Equipment Property Tax Relief Programs Betr Bete Maine Revenue Services Property Tax Division August 2 Ppt Download

How Do State Estate And Inheritance Taxes Work Tax Policy Center